Who owns the Federal

Reserve, who actually controls it, where does it get its money, and

whose interests is it serving?

(Hint: Not the American People)

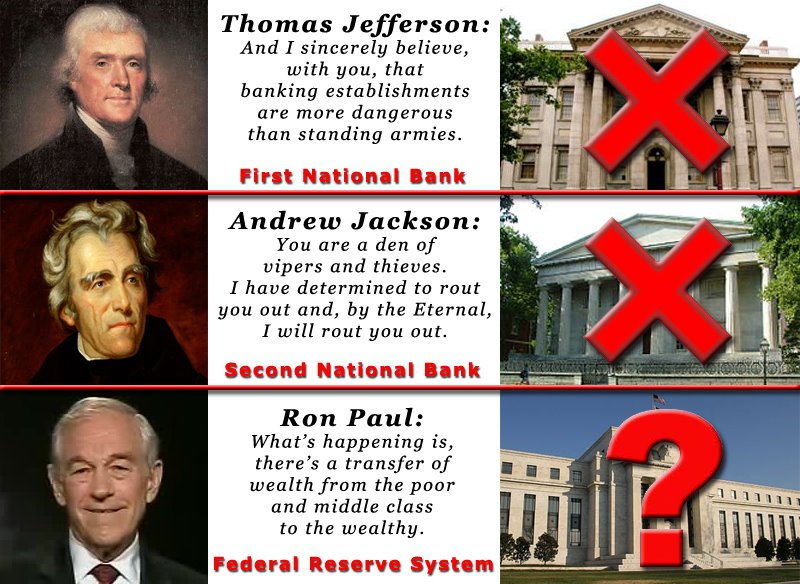

Not Private and Not for Profit?

The Fed’s website insists that it is not a private corporation, is not operated for profit, and is not

funded by Congress. But is that true? The Federal Reserve was set up in

1913 as a “lender of last resort” to backstop bank runs, following a

particularly bad bank panic in 1907. The Fed’s mandate was then and

continues to be to keep the private banking system intact; and that

means keeping intact the system’s most valuable asset, a monopoly on

creating the national money supply.

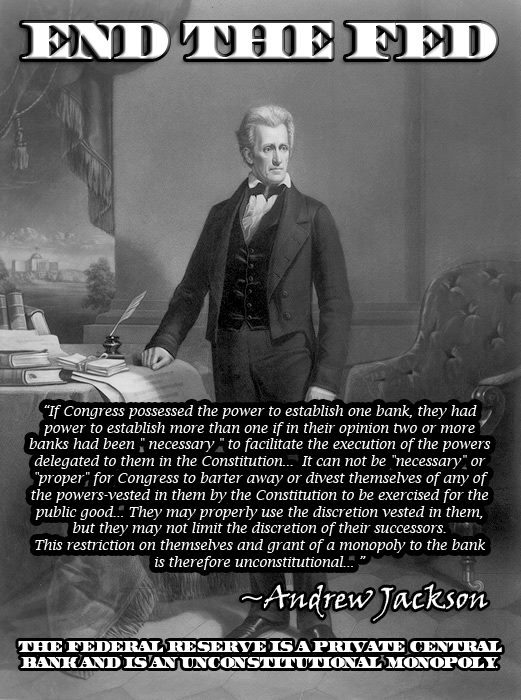

Which is illegal and AGAINST the US Constitution.

Except for coins, every dollar in

circulation is now created privately as a debt to the Federal Reserve or

the banking system.

The 12 regional Federal Reserve

Banks, which were established by Congress as the operating arms of the FED's central banking system, are organized much like private

corporations, because the FED is a private bank. For

example, the Reserve Banks issue shares of stock to member banks.

However, owning Reserve Bank stock is quite different from owning stock

in a private company. The Reserve Banks are not operated for profit, and

ownership of a certain amount of stock is, by law, a condition of

membership in the System. The stock may not be sold, traded, or pledged

as security for a loan; dividends are, by law, 6 percent per year.

The Federal Reserve is considered an

independent central bank because its decisions do not have to be

ratified by the President or anyone else in the executive or legislative

branch of government, it does not receive funding appropriated by

Congress, and the terms of the members of the Board of Governors span

multiple presidential and congressional terms.”

The Federal Reserve’s income is

derived primarily from the interest on U.S. government securities that

it has acquired through open market operations. . . . After paying its

expenses, the Federal Reserve turns the rest of its earnings over to the

U.S. Treasury.

1. The Fed is privately owned.

Its shareholders are private banks. In fact, 100% of its shareholders

are private banks. None of its stock is owned by the government.

2. The fact that the Fed does not get “appropriations” from

Congress basically means that it gets its money from Congress without

congressional approval, by engaging in “open market operations.”

Here is how it works: When the government is short of funds, the

Treasury issues bonds and delivers them to bond dealers, which auction

them off. When the Fed wants to “expand the money supply” (create

money), it steps in and buys bonds from these dealers with newly-issued

dollars acquired by the Fed for the cost of writing them into an account

on a computer screen. These maneuvers are called “open market

operations” because the Fed buys the bonds on the “open market” from the

bond dealers. The bonds then become the “reserves” that the banking

establishment uses to back its loans. In another bit of sleight of hand

known as “fractional reserve” lending, the same reserves are lent many

times over, further expanding the money supply, generating interest for

the banks with each loan. It was this money-creating process that

prompted Wright Patman, Chairman of the House Banking and Currency

Committee in the 1960s, to call the Federal Reserve “a total

money-making machine.”

When the Federal Reserve writes a check for a government bond it does exactly what any bank does, it creates money, it created money purely and simply by writing a check. The Fed generates profits for its shareholders.

The interest on bonds acquired with its newly-issued Federal Reserve

Notes pays the Fed’s operating expenses plus a guaranteed 6% return to

its banker shareholders. A mere 6% a year may not be considered a profit

in the world of Wall Street high finance, but most businesses that

manage to cover all their expenses and give their shareholders a

guaranteed 6% return are considered “for profit” corporations.

In addition to this guaranteed 6%, the banks will now be getting

interest from the taxpayers on their “reserves.” The basic reserve

requirement set by the Federal Reserve is 10%. The website of the

Federal Reserve Bank of New York explains that as money is redeposited

and relent throughout the banking system, this 10% held in “reserve” can

be fanned into ten times that sum in loans; that is, $10,000 in

reserves becomes $100,000 in loans. Federal Reserve Statistical Release

H.8 puts the total “loans and leases in bank credit” as of September 24,

2008 at $7,049 billion. Ten percent of that is $700 billion. That means

we the taxpayers will be paying interest to the banks on at least $700

billion annually – this so that the banks can retain the reserves to

accumulate interest on ten times that sum in loans.

No comments:

Post a Comment