Sunday, May 25, 2014

Water Water Everywhere and not a Drop to Drink

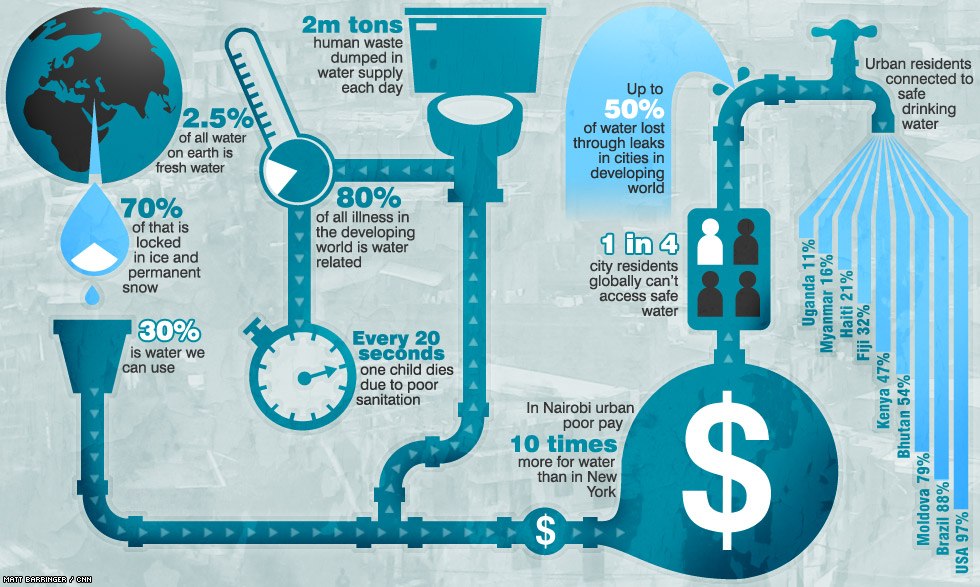

A troubling trend in the private and public water sector is accelerating worldwide. The new “water barons” — the Wall Street banks and elitist multibillionaires — are SECRETLY and QUIETLY buying up water all over the world at unprecedented pace.

Make no mistake...this is about control. People can live 3 months without food, but without WATER only 3 days. I assure you by that 3rd day the person who has been without water is hallucinating and having heart palpitation. During WW2, men who became trapped or lost in the desert of North Africa were found dead with motor oil, paint, and gasoline in their stomachs. Because the thirst for water had gotten so great that they consumed any liquid they had on hand.

The reason these Uber-rich are buying up water is the same reason they have bought up most of the agriculutrable land on every continent.

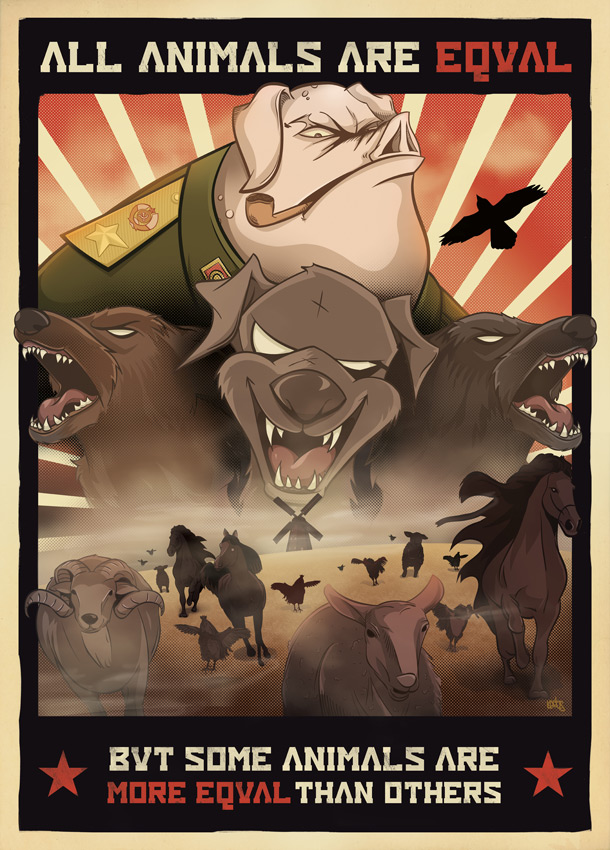

Control

Control

Control

Something else that is not being said is that the REAL reason the earth is becoming hotter is because the SUN is acting in a manner never seen before. This is why the major governments of the world started the geo-engineering project which is known publicly as Chemtrails. The dumping of metric tons of metal particulates into the upper atmosphere is reflecting SOME of the SUN'S power back into space. This Geo-enginering project is is also why Monasanto has geneticly engineered soy, corn which can handle high levels of heavy metals. The Sun is getting hotter and has increased its output. As such, those who have seen the secret data know that if this trend continues water will become more valuable then gold, literally.

Lets look at what the financial powerhouses of the Global elite are doing quickly and quietly....

Familiar mega-banks and investing powerhouses such as Goldman Sachs, JP Morgan Chase, Citigroup, UBS, Deutsche Bank, Credit Suisse, Macquarie Bank, Barclays Bank, the Blackstone Group, Allianz, and HSBC Bank, among others, are consolidating their control over water. Wealthy tycoons such as T. Boone Pickens, former President George H.W. Bush and his family, Hong Kong’s Li Ka-shing, Philippines’ Manuel V. Pangilinan and other Filipino billionaires, and others are also buying thousands of acres of land with aquifers, lakes, water rights, water utilities, and shares in water engineering and technology companies all over the world.

The second disturbing trend is that while the new water barons are buying up water all over the world, governments are moving fast to limit citizens’ ability to become water self-sufficient (as evidenced by the well-publicized Gary Harrington’s case in Oregon, in which the state criminalized the collection of rainwater in three ponds located on his private land, by convicting him on nine counts and sentencing him for 30 days in jail). Let’s put this criminalization in perspective:

Billionaire T. Boone Pickens owned more water rights than any other individuals in America, with rights over enough of the Ogallala Aquifer to drain approximately 200,000 acre-feet (or 65 billion gallons of water) a year. But ordinary citizen Gary Harrington cannot collect rainwater runoff on 170 acres of his private land.

It’s a strange New World Order in which multibillionaires and elitist banks can own aquifers and lakes, but ordinary citizens cannot even collect rainwater and snow runoff in their own backyards and private lands.

“Water is the oil of the 21st century.” Andrew Liveris, CEO of DOW Chemical Company (quoted in The Economist magazine, August 21, 2008)

“Why Big Banks May Be Buying up Your Public Water System,” in which I detailed how both mainstream and alternative media coverage on water has tended to focus on individual corporations and super-investors seeking to control water by buying up water rights and water utilities. But paradoxically the hidden story is a far more complicated one. I argued that the real story of the global water sector is a convoluted one involving “interlocking globalized capital”: Wall Street and global investment firms, banks, and other elite private-equity firms — often transcending national boundaries to partner with each other, with banks and hedge funds, with technology corporations and insurance giants, with regional public-sector pension funds, and with sovereign wealth funds — are moving rapidly into the water sector to buy up not only water rights and water-treatment technologies, but also to privatize public water utilities and infrastructure.

Now, in 2012, we are seeing this trend of global consolidation of water by elite banks and tycoons accelerating. In a JP Morgan equity research document, it states clearly that “Wall Street appears well aware of the investment opportunities in water supply infrastructure, wastewater treatment, and demand management technologies.” Indeed, Wall Street is preparing to cash in on the global water grab in the coming decades. For example, Goldman Sachs has amassed more than $10 billion since 2006 for infrastructure investments, which include water.

A 2008 New York Times article mentioned Goldman Sachs, Morgan Stanley, Credit Suisse, Kohlberg Kravis Roberts, and the Carlyle Group, to have “amassed an estimated an estimated $250 billion war chest — must of it raised in the last two years — to finance a tidal wave of infrastructure projects in the United States and overseas.”

By “water,” I mean that it includes water rights (i.e., the right to tap groundwater, aquifers, and rivers), land with bodies of water on it or under it (i.e., lakes, ponds, and natural springs on the surface, or groundwater underneath), desalination projects, water-purification and treatment technologies (e.g., desalination, treatment chemicals and equipment), irrigation and well-drilling technologies, water and sanitation services and utilities, water infrastructure maintenance and construction (from pipes and distribution to all scales of treatment plants for residential, commercial, industrial, and municipal uses), water engineering services (e.g., those involved in the design and construction of water-related facilities), and retail water sector (such as those involved in the production, operation, and sales of bottled water, water vending machines, bottled water subscription and delivery services, water trucks, and water tankers).

Update of My 2008 Article: Mega-Banks See Water as a Critical Commodity

Since 2008, many giant banks and super-investors are capturing more market share in the water sector and identifying water as a critical commodity, much hotter than petroleum.

Goldman Sachs: Water Is Still the Next Petroleum

In 2008, Goldman Sachs called water “the petroleum for the next century” and those investors who know how to play the infrastructure boom will reap huge rewards, during its annual “Top Five Risks” conference. Water is a U.S.$425 billion industry, and a calamitous water shortage could be a more serious threat to humanity in the 21st century than food and energy shortages, according to Goldman Sachs’s conference panel. Goldman Sachs has convened numerous conferences and also published lengthy, insightful analyses of water and other critical sectors (food, energy).

Goldman Sachs is positioning itself to gobble up water utilities, water engineering companies, and water resources worldwide. Since 2006, Goldman Sachs has become one of the largest infrastructure investment fund managers and has amassed a $10 billion capital for infrastructure, including water.

In March 2012, Goldman Sachs was eyeing Veolia’s UK water utility business, estimated at £1.2 billion, and in July it successfully bought Veolia Water, which serves 3.5 million people in southeastern England.

Previously, in September 2003, Goldman Sachs partnered with one of the world’s largest private-equity firm Blackstone Group and Apollo Management to acquire Ondeo Nalco (a leading company in providing water-treatment and process chemicals and services, with more than 10,000 employees and operations in 130 countries) from French water corporation Suez S.A. for U.S.$4.2 billion.

In October 2007, Goldman Sachs teamed up with Deutsche Bank and several partners to bid, unsuccessfully, for U.K.’s Southern Water. In November 2007, Goldman Sachs was also unsuccessful in bidding for U.K. water utility Kelda. But Goldman Sachs is still looking to buy other water utilities.

In January 2008, Goldman Sachs led a team of funds (including Liberty Harbor Master Fund and the Pinnacle Fund) to buy U.S.$50 million of convertible notes in China Water and Drinks Inc., which supplies purified water to name-brand vendors like Coca-Cola and Taiwan’s top beverage company Uni-President. China Water and Drinks is also a leading producer and distributor of bottled water in China and also makes private-labeled bottled water (e.g., for Sands Casino, Macau).

Since China has one of the worse water problems in Asia and a large emerging middle class, its bottled-water sector is the fastest-growing in the world and it’s seeing enormous profits. Additionally, China’s acute water shortages and serious pollution could “buoy demand for clean water for years to come, with China’s $14.2 billion water industry a long-term investment destination” (Reuters, January 28, 2008).

The City of Reno, Nevada, was approached by Goldman Sachs for “a long-term asset leasing that could potentially generate significant cash for the three TMWA [Truckee Meadows Water Authority] entities. The program would allow TMWA to lease its assets for 50 years and receive an up-front cash payment” (Reno News & Review, August 28, 2008). Essentially, Goldman Sachs wants to privatize Reno’s water utility for 50 years. Given Reno’s revenue shortfall, this proposal was financially attractive. But the water board eventually rejected the proposal due to strong public opposition and outcry.

Citigroup: The Water Market Will Soon Eclipse Oil, Agriculture, and Precious Metals

Citigroup’s top economist Willem Buitler said in 2011 that the water market will soon be hotter the oil market (for example, see this and this):

“Water as an asset class will, in my view, become eventually the single most important physical-commodity based asset class, dwarfing oil, copper, agricultural commodities and precious metals.”In its recent 2012 Water Investment Conference, Citigroup has identified top 10 trends in the water sector, as follows:

1. Desalination systems

2. Water reuse technologies

3. Produced water / water utilities

4. Membranes for filtration

5. Ultraviolet (UV) disinfection

6. Ballast-water treatment technologies

7. Forward osmosis used in desalination

8. Water-efficiency technologies and products

9. Point-of-use treatment systems

10. Chinese competitors in water

Specifically, a lucrative opportunity in water is in hydraulic fracturing (or fracking), as it generates massive demand for water and water services. Each oil well developed requires 3 to 5 million gallons of water, and 80% of this water cannot be reused because it’s three to 10 times saltier than seawater. Citigroup recommends water-rights owners sell water to fracking companies instead of to farmers because water for fracking can be sold for as much as $3,000 per acre-foot instead of only $50 per acre/foot to farmers.

The ballast-water treatment sector, currently at $1.35 billion annually, is estimated to reach $30 to $50 billion soon. The water-filtration market is expected to outgrow the water-equipment market: Dow estimates it to be a $5 billion market annually instead of only $1 billion now.

Citigroup is aggressively raising funds for its war chest to participate in the coming tidal wave of infrastructure privatization: in 2007 it established a new unit called Citi Infrastructure Investors through its Citi Alternative Investments unit. According to Reuters, Citigroup “assembled some of the biggest names in the infrastructure business at the same time it is building a $3 billion fund, including $500 million of its own capital. The fund, according to a person familiar with the situation, will have only a handful of outside investors and will be focused on assets in developed markets” (May 16, 2007). Citigroup initially sought only U.S.$3 billion for its first infrastructure fund but was seeking U.S.$5 billion in April 2008 (Bloomberg, April 7, 2008).

Citigroup partnered with HSBC Bank, Prudential, and other minor partners to acquire U.K.’s water utility Kelda (Yorkshire Water) in November 2007. This week, Citigroup signed a 99-year lease with the City of Chicago for Chicago’s Midway Airport (it partnered with John Hancock Life Insurance Company and a Canadian private airport operator). Insiders said that Citigroup is among those bidding for the state-owned company Letiste Praha which operates the Prague Airport in the Czech Republic (Bloomberg, February 7, 2008).

As the five U.K. water utility deals illustrate, typically no one single investment bank or private-equity fund owns the entire infrastructure project — they partner with many others. The Citigroup is now entering India’s massive infrastructure market by partnering the Blackstone Group and two Indian private finance companies; they have launched a U.S.$5 billion fund in February 2007, with three entities (Citi, Blackstone, and IDFC) jointly investing U.S.$250 million. India requires about U.S.$320 billion in infrastructure investments in the next five years (The Financial Express, February 16, 2007).

UBS: Water Scarcity Is the Defining Crisis of the 21st Century

In 2006, UBS Investment Research, a division of Switzerland-based UBS AG, Europe’s largest bank by assets, entitled its 40-page research report, “Q-Series®:Water”—“Water scarcity: The defining crisis of the 21st century?” (October 10, 2006) In 2007, UBS, along with JP Morgan and Australia’s Challenger Fund, bought UK’s Southern Water for £4.2biillion.

Credit Suisse: Water Is the “Paramount Megatrend of Our Time”

Credit Suisse published its report about Credit Suisse Water Index (January 21, 2008) urged investors that “One way to take advantage of this trend is to invest in companies geared to water generation, preservation, infrastructure treatment and desalination. The Index enables investors to participate in the performance of the most attractive companies….” The trend in question, according to Credit Suisse, is the “depletion of freshwater reserves” attributable to “pollution, disappearance of glaciers (the main source of freshwater reserves), and population growth, water is likely to become a scarce resource.”

Credit Suisse recognizes water to be the “paramount megatrend of our time” because of a water-supply crisis might cause “severe societal risk” in the next 10 years and that two-thirds of the world’s population are likely to live under water-stressed conditions by 2025. To address water shortages, it has identified desalination and wastewater treatment as the two most important technologies.

Three sectors for good investments include the following:

§ Membranes for desalination and wastewater treatment

§ Water infrastructure — corrosion resistance, pipes, valves, and pumps

§ Chemicals for water treatment

It also created the Credit Suisse Water Index which has the equally weighed index of 30 stocks out of 128 global water stocks. For investors, it offered “Credit Suisse PL100 World Water Trust (PL100 World Water),” launched in June 2007, with $112.9 million.

Credit Suisse partnered with General Electric (GE Infrastructure) in May 2006 to establish a U.S.$1 billion joint venture to profit from privatization and investments in global infrastructure assets. Each partner will commit U.S.$500 million to target electricity generation and transmission, gas storage and pipelines, water facilities, airports, air traffic control, ports, railroads, and toll roads worldwide.

This joint venture has estimated that the developed market’s infrastructure opportunities are at U.S.$500 billion, and emerging world’s infrastructure market is U.S.$1 trillion in the next five years (Credit Suisse’s press release, May 31, 2006).

In October 2007, Credit Suisse partnered with Cleantech Group (a Michigan-based market-research, consulting, media, and executive-search firm that operates cleantech forums) and Consensus Business Group (a London-based equity firm owned by U.K. billionaire Vincent Tchenguiz) to invest in clean technologies worldwide.

The technologies will also clean water technologies.

During its Asian Investment Conference, it said that “Water is a focus for those in the know about global strategic commodities. As with oil, the supply is finite but demand is growing by leaps and unlike oil there is no alternative.” (Credit Suisse, February 4, 2008). Credit Suisse sees the global water market with U.S.$190 billion in revenue in 2005 and was expected to grow to U.S.$342 billion by 2010. It sees most significant growth opportunities in China.

JPMorgan Chase: Build Infrastructure War Chests to Buy Water, Utilities, and Public Infrastructure Worldwide

One of the world’s largest banks, JPMorgan Chase has aggressively pursued water and infrastructure worldwide. In October 2007, it beat out rivals Morgan Stanley and Goldman Sachs to buy U.K.’s water utility Southern Water with partners Swiss-based UBS and Australia’s Challenger Infrastructure Fund. This banking empire is controlled by the Rockefeller family; the family patriarch David Rockefeller is a member of the elite and secretive Bilderberg Group, Council on Foreign Relations, and Trilateral Commission.

JPMorgan sees infrastructure finance as a global phenomenon, and it is joined by its global peers in investment and banking institution in their rush to cash in on water and infrastructure. JPMorgan’s own analysts estimate that the emerging markets’ infrastructure is approximately U.S.$21.7 trillion over the next decade.

JPMorgan created a U.S.$2 billion infrastructure fund to go after India’s infrastructure projects in October 2007. The targeted projects are transportation (roads, bridges, railroads) and utilities (gas, electricity, water). India’s finance minister has been estimated that India requires about U.S.$500 billion in infrastructure investments by 2012.

In this regard, JPMorgan is joined by Citigroup, the Blackstone Group, 3i Group (Europe’s second-largest private-equity firm), and ICICI Bank (India’s second-largest bank) (International Herald Tribune, October 31, 2007).

Its JPMorgan Asset Management has also established an Asian Infrastructure & Related Resources Opportunity Fund which held a first close on U.S.$500 million (€333 million) and will focus on China, India, and other Southern Asian countries, with the first two investments in China and India (Private Equity Online, August 11, 2008). The fund’s target is U.S.$1.5 billion.

JPMorgan’s Global Equity Research division also published a 60-page report called “Watch water: A guide to evaluating corporate risks in a thirsty world” (April 1, 2008).

In 2010, J.P. Morgan Asset Management and Water Asset Management led a $275 million buyout bid for SouthWest Water.

Pay Attention or one day you will be in line to receive your water ration. That is IF you can afford to pay for your water ration. After all...They will tell you...

"The underground aquifers, the rivers, the lakes, the ponds, the very rain that falls from the sky is OURS...We bought it, We own it, just like we own you SLAVE..."

Subscribe to:

Comments (Atom)