"The Bretton Woods Agreement"

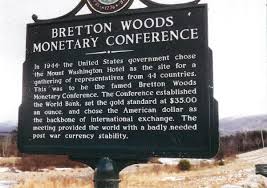

In July, 1944 representatives of the 44 Allied nations met at the Mount Washington Hotel in Bretton Woods, New Hampshire to create an international economic system designed to govern post-war monetary relations between independent nation-states.

The meeting resulted in the now famous "Bretton Woods Agreement", which created the system of economic rules, institutions and procedures that were designed around the yet-future United Nations system. Bretton Woods established the International Monetary Fund (IMF) and the embryonic World Bank.

NOTE: Bretton Woods pegged the US dollar to the price of gold and pegged all other currencies against the value of the US dollar.

NOTE: Under Bretton Woods, the US dollar was fully convertible to gold on demand and the price of gold remained relatively stable at $35.00 per Troy ounce.

The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained the exchange rate by tying its currency to the U.S. dollar and the ability of the IMF to bridge temporary imbalances of payments.

NOTE: In August, 1971 the United States unilaterally pulled out of the Bretton Woods Agreement, breaking the link between gold and the US dollar. For the first time in history, formal links between major world currencies and real commodities was severed.

The action, known as the "Nixon Shock" came in response to America's growing war debt, which resulted in the US experiencing, for the first time in the 20th century, a balance of payments and trade deficit.

By 1971 the Federal Reserve had increased the money supply by 10%, forcing the other Bretton Woods countries into the position of being forced to prop up the US dollar.

To stabilize the economy and combat the 1970 inflation rate of 5.84%,[3] on August 15, 1971, President Nixon imposed a 90-day wage and price freeze, a 10 percent import surcharge, and, most importantly, "closed the gold window", ending convertibility between US dollars and gold.

NOTE: The President and fifteen advisers made that decision without consulting the members of the international monetary system.

The Nixon Shock immediately caused the US dollar to depreciate. Because oil was priced in dollars, OPEC was suddenly receiving less real income for the same price. The OPEC cartel issued a joint communique stating that, from then on, they would price a barrel of oil against gold.

The Nixon Shock in 1971 was met by the Oil Shock of 1973. During the 1973 Yom Kippur War, President Nixon defied Saudi pressure and authorized Operation Nickel Grass, a strategic airlift of weapons and ammunition to Israel.

On October 16th, OPEC announced it was raising the cartel's price per barrel for oil by 70%. It cut production the next day.

By 1974 the price of oil had quadrupled. The stock market crashed. De Ja Vue anyone?

The entire World's economy runs on oil and US dollars. Since the US dollar is worthless apart from it's death grip on oil. If at any time ANY Nation State begins to accept anything other then US dollars for oil and is not stopped then the US dollar will go into free fall. Apart from OIL there is no exchangeable value for the US Dollar.

These are ONLY the top 15 countries and their US Dollar reserves. These Units are in the MILLIONS and growing everyday.

In July, 1944 representatives of the 44 Allied nations met at the Mount Washington Hotel in Bretton Woods, New Hampshire to create an international economic system designed to govern post-war monetary relations between independent nation-states.

The meeting resulted in the now famous "Bretton Woods Agreement", which created the system of economic rules, institutions and procedures that were designed around the yet-future United Nations system. Bretton Woods established the International Monetary Fund (IMF) and the embryonic World Bank.

NOTE: Bretton Woods pegged the US dollar to the price of gold and pegged all other currencies against the value of the US dollar.

NOTE: Under Bretton Woods, the US dollar was fully convertible to gold on demand and the price of gold remained relatively stable at $35.00 per Troy ounce.

The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained the exchange rate by tying its currency to the U.S. dollar and the ability of the IMF to bridge temporary imbalances of payments.

NOTE: In August, 1971 the United States unilaterally pulled out of the Bretton Woods Agreement, breaking the link between gold and the US dollar. For the first time in history, formal links between major world currencies and real commodities was severed.

The action, known as the "Nixon Shock" came in response to America's growing war debt, which resulted in the US experiencing, for the first time in the 20th century, a balance of payments and trade deficit.

By 1971 the Federal Reserve had increased the money supply by 10%, forcing the other Bretton Woods countries into the position of being forced to prop up the US dollar.

To stabilize the economy and combat the 1970 inflation rate of 5.84%,[3] on August 15, 1971, President Nixon imposed a 90-day wage and price freeze, a 10 percent import surcharge, and, most importantly, "closed the gold window", ending convertibility between US dollars and gold.

NOTE: The President and fifteen advisers made that decision without consulting the members of the international monetary system.

The Nixon Shock immediately caused the US dollar to depreciate. Because oil was priced in dollars, OPEC was suddenly receiving less real income for the same price. The OPEC cartel issued a joint communique stating that, from then on, they would price a barrel of oil against gold.

The Nixon Shock in 1971 was met by the Oil Shock of 1973. During the 1973 Yom Kippur War, President Nixon defied Saudi pressure and authorized Operation Nickel Grass, a strategic airlift of weapons and ammunition to Israel.

On October 16th, OPEC announced it was raising the cartel's price per barrel for oil by 70%. It cut production the next day.

By 1974 the price of oil had quadrupled. The stock market crashed. De Ja Vue anyone?

The

oil shock produced chaos in the US, with long lines, price controls and

even gas rationing. But the Saudis began to break with OPEC on key

issues, ending OPEC's hegemony over global oil prices.

The US cut a deal with the House of Saud to support the regime and in

exchange, the House of Saud agreed to go along with Bretton Woods 2,

which, according to the agreement, the United States would offer military protection for Saudi Arabia’s oil fields. The U.S. also agreed to provide the Saudis with weapons, and perhaps most importantly, guaranteed protection from Israel.

The

Saudi royal family knew a good deal when they saw one. They were more

than happy to accept American weapons and a U.S. guarantee to restrain

attacks from neighboring Israel.

Naturally, the Saudis wondered how much was all of this U.S. military muscle was going to cost…

What exactly did the United States want in exchange for their weapons and military protection?

The Americans laid out their terms. They were simple, and two-fold.

1) The Saudis must agree to price all of their oil sales in U.S. dollars only. (In other words, the Saudis were to refuse all other currencies, except the U.S. dollar, as payment for their oil exports.)

2) The Saudis would be open to investing their surplus oil proceeds by purchasing U.S. debt securities issued by the Federal Reserve Bank.

Thus we have what is known today as the American Petro-Dollar. The only reason the US Dollar is worth anything at all is because you can only by a barrel of oil with US Dollars.

When Saddam Hussein tried to accept Euro's for Oil he was Overthrown and hung like a common criminal. When Muammar Gaddafi tried accepting gold for Libyan oil he was over thrown and murdered in the street like a dog. Now, ashar Hafez al-Assad the current President of Syria has made the same mistake by intimating that he would be willing to accept something other then US Dollars for Syrian oil. He too will soon be deposed and murdered.

The entire World's economy runs on oil and US dollars. Since the US dollar is worthless apart from it's death grip on oil. If at any time ANY Nation State begins to accept anything other then US dollars for oil and is not stopped then the US dollar will go into free fall. Apart from OIL there is no exchangeable value for the US Dollar.

These are ONLY the top 15 countries and their US Dollar reserves. These Units are in the MILLIONS and growing everyday.

| 1 | 3,240,010 | ||||||||

| 2 | 1,270,547 | ||||||||

(EU member states which have adopted the euro, incl. ECB) |

862,900 | ||||||||

| 3 | 592,358 | ||||||||

| 4 | 514,317 | ||||||||

| 5 | 391,024 | ||||||||

| 6 | 383,612 | ||||||||

| 7 | 373,910 | ||||||||

| 8 | 310,872 | ||||||||

| 291,879 | |||||||||

| 9 | 286,019 | ||||||||

| 10 | 239,522 | ||||||||

| 11 | 237,714 | ||||||||

| 12 | 185,900 | ||||||||

| 13 | 175,296 | ||||||||

| 14 | 173,245 | ||||||||

| 15 | 172,455 |