The only thing Democrats know is to tax and spend other people's money. The Illinois state Democrats think they can simply raise every time they run amok of their fiscal irresponsibility. At NO time did it occur to cut spending, cut pork, and pet projects.

Illinois edges near becoming the first U.S. state to ever be rated junk bond status, the Democrat-controlled legislature of the bankrupt state of Illinois has just voted to slam its citizens with a hefty 32 percent hike in state income taxes.

After a series of delays, as a legislature obviously embarrassed by

its own actions dithered, the State House finally approved of the

Senate’s override of the governor’s veto with a 71-42 vote, burdening

the state with a massive income tax hike. It was a vote that saw ten of

the state’s Republican contingent abandon Republican values and join the

Democrats in approval.

Thursday’s vote permanently increases the state’s personal income tax

rate from 3.75 percent to 4.95 percent. It also raises the burden on

businesses, raising the rate from 5.9 percent to seven. It all amounts

to a 32 percent hike for the average Illinoisan and a $5 billion tax

hike overall.

The new tax hike is all the more galling because Illinois already has the highest property taxes in the nation,

a fact that often forces retirees out of their homes to flee to other

states. This is also a situation not lost on the state’s black American

population, either. Illinois is witnessing a growing number of its

African-American citizens moving out of the state, with Chicago and Cook County residents leaving at the fastest rate.

On Thursday, Illinois Democratic House leader Michael Madigan only

needed three Republicans to jump ship and vote his way, but not only did

he get a whopping ten to do so, he also got five others who didn’t even

bother to vote. An additional five joined him in the early rounds of

deliberations, so Democrat Madigan knew he had the Republican votes

going into the matter.

Thursday’s vote came after the House and the Senate passed the

gigantic tax package this week only to have Illinois’ Republican

Governor, Bruce Rauner, veto the bill. Despite the veto, on Wednesday

the Senate voted to override the governor’s pen, sending the final vote

back to the House. But all day Wednesday, Speaker Madigan could not get

enough lawmakers together to make a quorum.

The task of overriding the veto was put off until Thursday, but even

then, the vote was temporarily halted when police put the capitol

building into lockdown

after discovering a mysterious white powder in the governor’s Capitol

office. The shutdown only lasted a short time, and, in due course, the

vote was back on.

Finally, by early evening on Thursday, the deed was done, and the tax hike was approved. The state that is losing more citizens to out-migration than any other state, one with the lowest number

of new jobs being created, and one losing business in droves just

saddled its people with even higher taxes and with no budget reforms

made and no cuts in spending implemented to boot.

Indeed, there was even more spending included in the disastrous

budget deal. Some of the earmarks added into the deal include $12.7

million for the construction of a new classroom building at the College

of Lake County, $10 million for the construction of a city center campus

at Joliet Junior College, $15 million for a Chicago Metra station, plus

much more.

The one thing the bill lacks is any cuts in spending or any budget

reforms. This inadequacy does nothing to stave off the threat to the

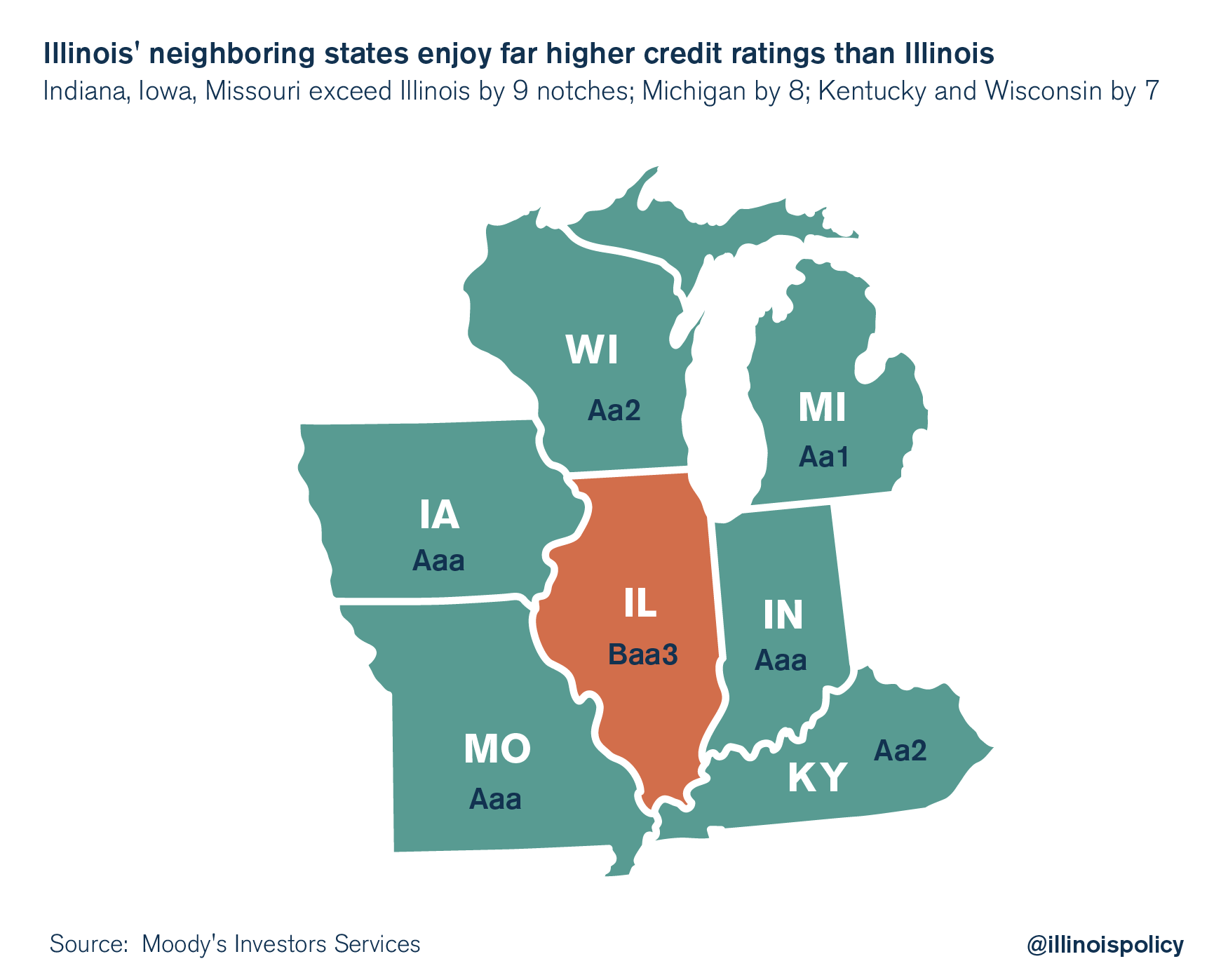

state’s bond rating which is already one of the poorest in the nation.

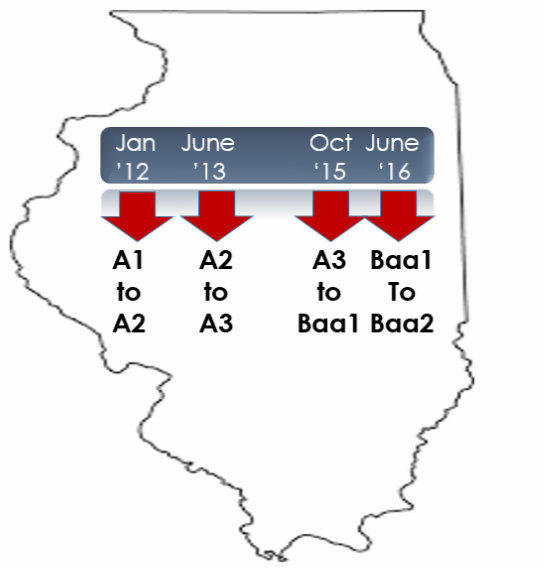

As June began, S&P and Moody’s both downgraded Illinois to near junk, the lowest ever for a U.S. State.

But even with the new budget finally approved, it isn’t likely that junk bond status can be avoided. Moody’s Investor Service warned on Wednesday that it will probably end up awarding Illinois with junk status despite the budget approval.

In fact, Moody’s said its coming downgrade would be a result of what the state’s Democrats are doing. In its July 5 statement, Moody’s said:

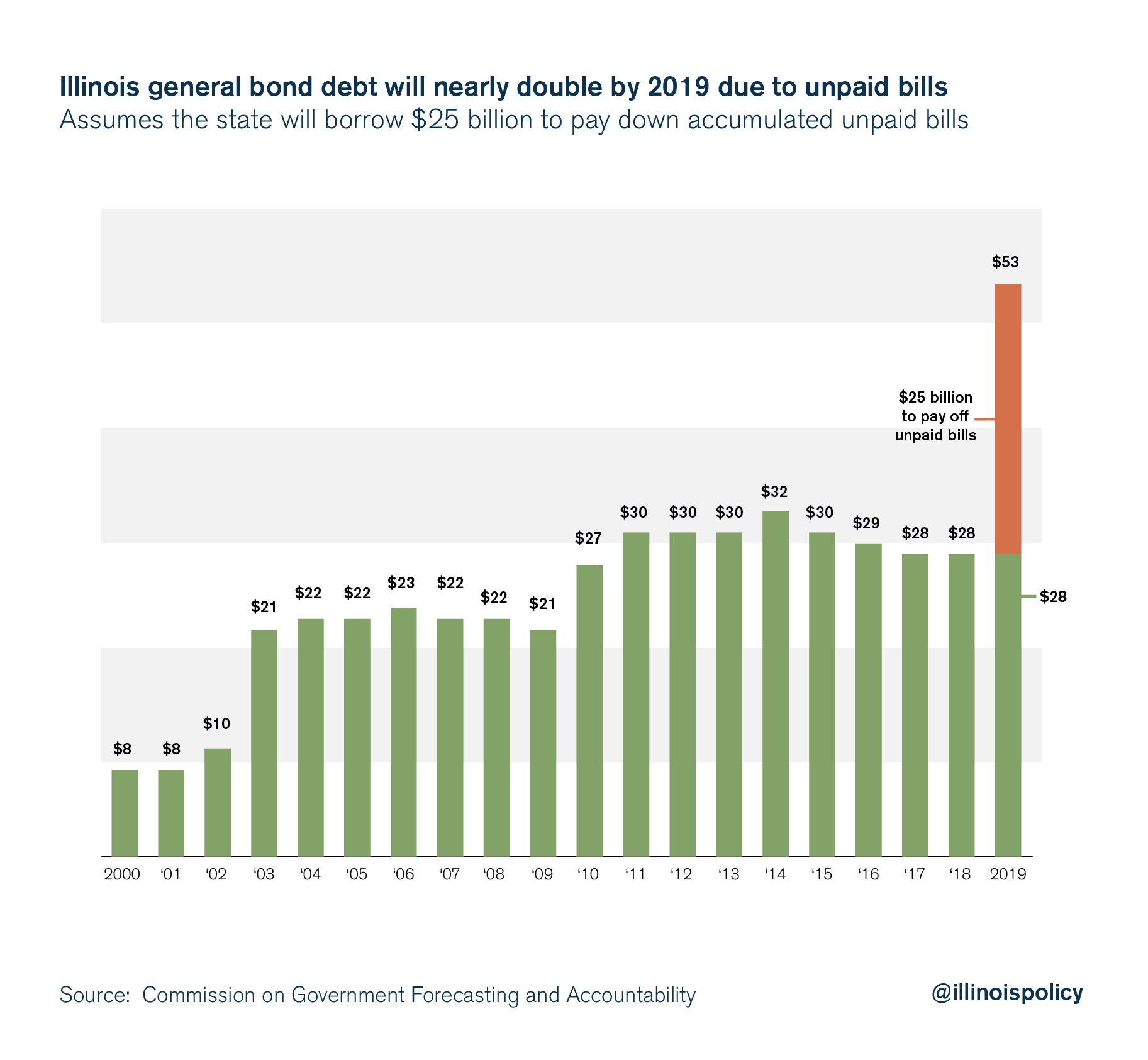

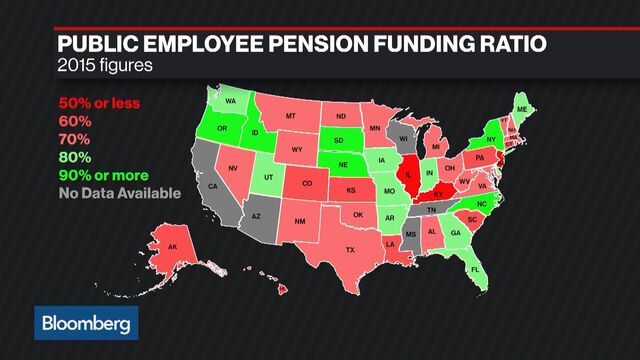

The decision to place the state’s ratings under review for Moody’s downgrade incorporates our expectation that the legislature will implement revenue increases, overriding the governor’s vetoes. The review will provide a limited amount of time for the Illinois General Assembly to finish voting on the measures, and for assessment of the plan’s credit implications. The review process will also address the likelihood of further deterioration in Illinois’ most pressing credit challenges: its severely underfunded pensions and a backlog of unpaid bills, which has doubled during the past year.

Moody’s also slammed the Democrats’ contention that a higher income

tax intake will allow Illinois lawmakers to borrow even more money to

spend on pet projects and fat union kickbacks.

Meanwhile, Illinois Republicans have a large number of their own to

thank for this latest outrage inflicted on the state’s beleaguered

citizens.

The ten Republicans who left Republican principles behind to join the Democrats were as follows:

Rep. Steve Andersson (65th District), Terri Bryant (115th), Mike

Fortner (49th), Norine Hammond (93rd), David Harris (53rd), Chad Hays

(104th), Sara Jimenez (99th), Bill Mitchell (87th), Reggie Phillips

(110th), and Michael Unes (91st).

Another five Republicans didn’t vote at all. That list includes

Jeanne Ives (42nd), Robert Pritchard (40th), Nick Sauer (51st), Grant

Wehrli (41st), Christine Winger (45th).

Five more voted for the tax hike in the first go around as well. They

include R. Pritchard (40th), John Cavaletto (107th), C.D. Davidsmeyer

(100th), Charlie Meier (108th), and David Reis (109th).

repost:breitbart.com/big-government/2017/07/06/bankrupt-illinois-slams-citizens-32-income-tax-hike-come/

No comments:

Post a Comment