The U.S. federal bureaucracy doesn’t often admit wrongdoing. This time it took a change in the political landscape, many businesses threatening legal action and a congressman with a background in banking to force the bureaucracy to admit to misconduct and to stop financial attacks on legal businesses that the Obama administration deems to be politically incorrect.

This week the Federal Deposit Insurance Corporation (FDIC) published a statement saying they are instituting changes to stop Operation Choke Point’s discriminatory practices against legal businesses. The U.S. Justice Department still contends that Operation Choke Point is an initiative designed to reduce unlawful fraud by “choking” illegal players out of U.S. financial institutions. However, under direction of the FDIC, Operation Choke Point also affected the banking relationships of many legal businesses, including those of gun stores and other firearms-related companies. Some law-abiding businesses had their long-standing banking relationships terminated as a result of threats from the FDIC to censure financial institutions that do business with gun stores and other firearms-related businesses. Some examples of legal businesses being harmed were included in a report by the House Oversight Committee; still more examples were documented in research done by The Heritage Foundation’s The Daily Signal.

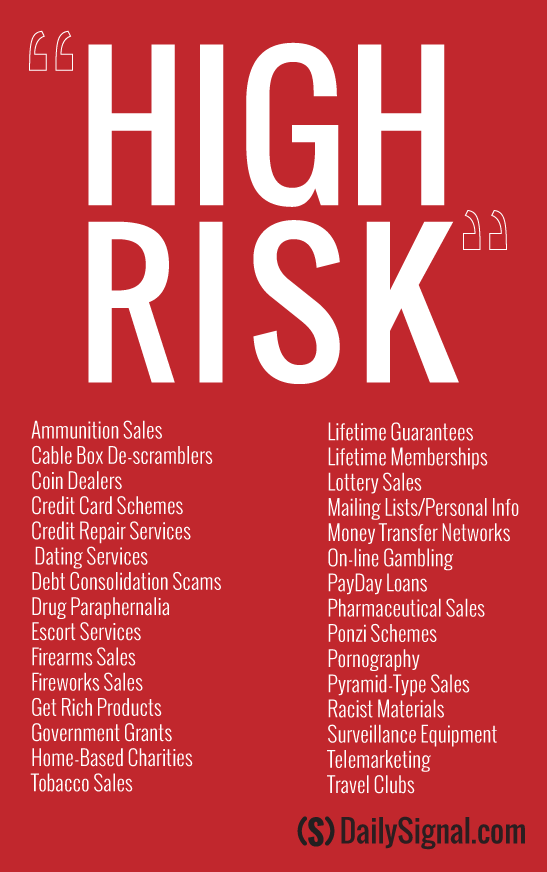

Operation Choke Point was an operation through which the Department of Justice was using various agencies/services under its power to pressure banks and credit companies to cut ties with “high risk” businesses. Not ironically, gun and ammunition sellers were categorized as “high risk.”

The letter from the FDIC says, “The FDIC is aware that some institutions may be hesitant to provide certain types of banking services due to concerns that they will be unable to comply with the associated requirements of the Bank Secrecy Act (BSA)….” As a result, the FDIC says it is now “encourage[ing] institutions to take a risk-based approach in assessing individual customer relationships rather than declining to provide banking services to entire categories of customers….”

U.S. Rep. Blaine Luetkemeyer (R-Mo.), who was once a bank regulator for the state of Missouri and who now is a member of the House Financial Services Committee, released a statement after a meeting with FDIC Chairman Martin Gruenberg and Vice Chairman Tom Hoenig, that said in part: “After a year of mounting pressure from Congress and outside organizations like the National Shooting Sports Foundation, top officials from the Federal Deposit Insurance Corporation finally acknowledged their involvement and wrongdoing in Operation Choke Point.

While I am very pleased the FDIC will put in place new polices and change the culture at the agency, there is still work to be done, specifically with the Department of Justice. I am pleased the National Shooting Sports Foundation supports my legislation, the Financial Institution Customer Protection Act, and I have no doubt the foundation will remain steadfast in educating its members and continuing the fight in ending Operation Choke Point once and for all.”

The FDIC will now require bank examiners to put any recommendation to end a banking relationship in writing. The bank examiner also must explain what law or regulation they believe is or was being violated.

During the investigation by Congress emails surfaced showing FDIC investigators “scheming to influence banks’ decisions on who to do business … [to ensure] banks ‘get the message’ about the businesses the regulators don’t like, and pressuring banks to cut credit or close those accounts, effectively discouraging entire industries.”

“The FDIC has ILLEGALLY allowed a culture within their agency to blossom that they believe it’s okay to impose their personal opinions and value system in a regulatory way. They are not a regulatory police—their job is to enforce the law.”

The FDIC admitted wrongdoing and is making administrative changes, but—as in the scandal within the IRS—the public is pushing for legislation to make certain another administration doesn’t use the FDIC to attack businesses it doesn’t like—what if, for example, a Republican administration used the FDIC to attack the finances of Planned Parenthood?

The bill would also create a legal path for citizens to take action against banks or regulatory institutions that terminate their banking relationships for ideological reasons.

http://www.forbes.com/sites/frankminiter/2015/01/30/fdic-admits-to-strangling-legal-gun-stores-banking-relationships/#5459f99327fd

No comments:

Post a Comment